Alibaba (NYSE:BABA)

//Quantitative & Qualitative investment analysis.

Grab a bowl of hotpot 🍲; this is part 1/2 of my Alibaba write-up. The first instalment covers Alibaba’s businesses and moat. Part two will cover risks, intrinsic valuation and catalysts, coming very soon.

Alibaba is a massive business, so even after splitting this letter across two posts, I have to skimp on the analysis of individual sub-businesses. My full report would be much, much too long (and boring) to include here. I’m also leaving out management analysis as there are so many directors.

This one is still quite long but aims to give you enough information to feel comfortable talking about Alibaba the business. Let’s dig in.

Business Summary

Alibaba was founded in 1999 by 18 people led by Jack Ma, a former English teacher from Hangzhou, China. The company’s founders believed that the Internet would level the playing field by enabling small enterprises to leverage technology to compete more effectively in domestic and global economies.

Their mission is to build a company that spans over three centuries (102 years) and are playing ‘the long game’. It is evident from the management’s goals and capital allocation that they optimise long-term earnings power and anti-fragility. Most people are aware that Alibaba is the leader in e-commerce in China. However, many don’t know the depth and breadth of this company (myself included), as it has hundreds of smaller businesses within the Alibaba umbrella. They are also one of the dominant VC players in China, alongside Tencent.

Deeply understanding all of these sub-businesses and minority interests is near impossible. I cover the top ~10, which contribute <99% to top-line revenues. Other smaller investments contribute to the huge optionality of Alibaba.

The below image is a 10,000-foot view of Alibaba’s businesses. They have their fingers in a lot of pies:

A mental model for how Alibaba operates, in my opinion:

Currently, Alibaba has four main business segments:

Core Commerce

A breakdown of the major businesses in core commerce:

Alibaba derived 87% of revenue (US$109,480m) from core commerce in 2021. This is the crown jewel of the business and the most important aspect of the company to analyse. Within core commerce, 66% (US$72,298) of total revenues are from China retail commerce.

China retail commerce is primarily from performance-based marketing services, set by bidding systems (think Google Adwords). Revenue consists of customer management which is 43% of China retail commerce. Customer management is keyword ads, in-feed marketing, and display marketing based on cost per click or thousand impressions. They also derive revenue in this area through commissions or transactions and influencer marketing.

Alibaba makes most of its revenue from advertising on their e-commerce platforms.

Alibaba is huge in China. They have ~90% retail marketplace penetration in developed areas and ~45% penetration in less developed areas. Their recent quarterly report (August 2021) stated 925M monthly active users in their commerce products.

Alibaba has 925M monthly active users, benefiting from the continuing expansion of the Chinese middle class.

Revenue from other parts of core commerce, including wholesale and international, is derived from marketing activities like the ones listed above, membership fees and value-added services.

Lazada is their international commerce company, targeting mainly southeast Asia. They compete directly with Shopee and have 100M+ monthly active consumers, with 90% YOY order growth for the quarter ended June 30, 2021. Lazada runs its own logistics network, with more than 75% of its parcels sent through its facilities.

Alibaba has other businesses capturing wholesale commerce within China and internationally and their logistics network Cainiao.

Cloud

Revenue from cloud computing in 2021 was US$9,176 million, an increase of 50% compared to the fiscal year 2020. This represents 8% of total revenue and is based on the duration and usage of Alibaba’s cloud services. It is currently unprofitable, losing ~US$1.3 billion in 2021.

Alibaba Cloud has been slowly coming closer to profitability but steadily increasing customer numbers, with a market share of around 40% in China. There is currently a large runway for growth both within China and internationally. China IT spend is roughly one-third of US IT spend. Chinese businesses are slowly migrating to the cloud, as they generally distrust it, reminiscent of the US 10-15 years ago.

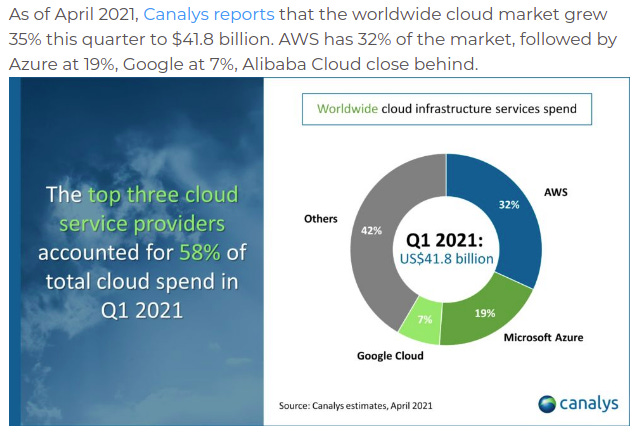

They are the world’s third/fourth largest cloud provider, after Amazon and Microsoft, a similar size to Google Cloud. Their closest rival in China is Huawei Cloud, and Tencent cloud, each with about 15% market share.

The cloud market is growing fast itself:

Digital Media and Entertainment

Digital Media and Entertainment represents 4% (US$4,760) of total revenue for 2021 and is currently unprofitable, losing ~US$1.5 billion this fiscal year. This business segment is also moving closer to profitability. Revenue is derived from advertising and subscription fees. They operate Youku, the third-largest online video platform, facing stiff competition from Baidu and Tencent. On this service, they license content, self-produce and allow user-generated content. Youku is shifting towards mainly self-production of content, with its daily average subscriber base increasing 17% YOY in 2021.

Alibaba pictures produce digital media content but are more focused on offline entertainment such as cinemas. Alibaba pictures had declining revenue and gross profits in 2020, primarily due to COVID-19 and the competition in this space domestically.

Innovation Initiatives and Others

The other bets business segment accounted for 1% (US$739 million) of total revenues, also currently unprofitable, losing ~US$2.3 billion. Revenue is generated in various ways from both consumers and enterprise customers. This segment has many businesses used to create synergies with other parts of Alibaba and bring more users into the ecosystem.

These moonshots are the seeds for the future.

I put Ant Group in this segment (formerly known as Alipay), of which Alibaba has a 33% equity interest. Ant Group is massive, with four main business segments, payment, wealth management, micro-financing and insurance. They serve as a middleman, partnering banks and consumers in financial products. They provide value to consumers and enterprises because of the massive amount of data they can crunch from all businesses arms.

Ant Group got spun off because of regulation restrictions from the Chinese government. Expect more regulation in credit businesses domestically, as the party has identified this as an existential issue for the country. Ant Group faces massive headwinds in this space, with further restrictions which will undoubtedly impact business results.

Moat

Data (Scale and Cost)

The sheer scale of data that Alibaba collects through all their business arms gives them an incredible advantage over competitors. This big data allows them to characterise and personalise their services to millions of customers with high accuracy. Through their machine learning and data processing innovation, they gain advantages like more revenue per customer and lower risk on lending.

Future companies will be ‘algorithm first’, which we can see emerging already, such as TikTok. TikTok is a good case study of a company perfecting an algorithm for attention, the most valuable commodity of the 21st century. Tiktok was the fastest company to hit a $100B market cap until another Chinese company came along (Pinduoduo) with a similar’ algorithm and marketing first’ strategy.

Alibaba competes with other big Chinese tech companies on the data front. It’s a war of M&A between Tencent and Alibaba for acquiring startups for their intellectual and technological capital to improve their data processing and customer service across all businesses.

I believe that the data advantage scales linearly, not by a power law. Hence, the incremental benefit that Alibaba may have over a competitor allows them to provide marginally better customer service. Exponentially better service is more likely to arise from breakthroughs in the algorithms, as we have seen.

Overall, I would say that Tencent has a better VC track record than Alibaba.

Structural

Chinese firms listed on the Hong Kong and Shanghai exchanges are under some restrictions not applicable to US businesses. They have much stricter and more frequent reporting requirements and require businesses to be continuously profitable. This is a huge barrier, as it massively favours incumbents like Alibaba and Tencent as they can offset their developing businesses with their cash cows. Smaller companies don’t have that luxury, and the big companies can crush them because they can offer the same or a better product at a lower price.

Network

Several businesses within Alibaba are predicated on developing a network, with acquisitions aimed at strengthening these networks. As one of the largest companies in China, they have a large network moat, offering consumers a service for almost every aspect of their life. Having so many touchpoints allows them to collect data to further strengthen the network moat and lower costs/increase efficiencies widening the moat again.

Intangibles and Brand

Alibaba is one of the few Chinese companies with international mindshare. They have a very strong brand in China and the rest of Asia but struggle in western countries, attributed to trust issues and the US-China relationship.

Alibaba has some of the best and brightest in China, working to improve efficiencies in their business by developing algorithms and additional product offerings.

Part 2…

If you don’t want to miss part two, where I cover intrinsic value, risks and more subscribe to get it delivered to your inbox:

👋 End Notes

//Want more?

If you got value from this letter, do me a favour and share it!

Follow or message me on twitter @value_scientist, if you want to get in touch.

Ciao!