Alibaba Investment Hypothesis (2/2)

Is Alibaba invest-able? An analysis of risks & intrinsic value...

Hi! This post is the second half of my Alibaba write-up. You can find the first half here, where I explore the business and its moat. Part two will explore the risks and intrinsic valuation. If you want to read more stuff like this, usually on small caps or out of favour businesses, consider subscribing (free).

Let’s get into it.

Risks

Related Party Transactions

There was a US$1B loan to a founder Simor Xie to finance minority investment in Wasu (digital media broadcasting business in China). Seems a bit questionable to me. “These arrangements strengthened our strategic cooperation with Wasu to enhance our entertainment strategy”.

Simon Xie repaid the loads by March 2020. As of March 2020, there are no outstanding loans to Simon. This loan along with some other quirks of management suggests that their corporate governance leaves much to be desired.

The poor governance means you really have to trust management.

Pending SEC Inquiry

In 2016, the SEC started an investigation into any potential fraud. Alibaba is cooperating. Specifically, the SEC are looking at:

Consolidation policies and practices including prior practice of accounting for

Cainiao as an equity method investee.

Policies and practices applicable to related party transactions in general.

Reporting data from 11.11 global shopping festival.

As a Chinese company, there is little recourse for investors in the case of fraud. Its possible that revenue recognition on singles day may be pushing the accounting a bit.

You can read through all the correspondence the SEC has had with Alibaba management on the SEC website. They go into detail as to why they chose certain accounting practices and it seems reasonable to me (and the SEC, judging by their responses).

US & China

It’s possible that Alibaba will be delisted from the NYSE. Not a big deal, as Hong Kong shares are available.

A delisting would hurt the share price but not the intrinsic value of the business.

I think it is likely Alibaba will not be able to compete fairly in the US, or other western markets. We have seen issues around this with TikTok and Huawei in the US. With limited access to the US market, Alibaba will be fighting for market share in other parts of the world, like the Middle East, Africa and SE Asia. There are competitors in these markets, meaning Alibaba will have to invest significant amounts of money to compete against them, if they choose to.

Anti-trust

I believe Alibaba is less exposed to fines going forward as it is in e-commerce, which is less harmful to the Chinese consumer than various apps developed by other big Chinese tech.

Ultimately, the government has shown their intention to protect the consumer, above all else. The efficiency of these rulings are more disruptive than we see in the US, and ultimately probably better for the consumer. Shareholders need to keep this in mind, and think about the incentives of the government and the management. Are you a valued stakeholder? A good company will align their business with the governments interests, to avoid trouble. This is more prominent in the Chinese system, and if you don’t like that, you don’t have to invest there.

That said, there is still substantial risk for anti-trust issues, as China is a decade behind the US when it comes to laws around monopolies. No doubt there will be future fines, but I put my faith in the management to more carefully steer this ship in the future.

Additionally, Alibaba is a valuable asset to the Chinese economy, and there are no state players in e-commerce, so it’s unlikely we see Alibaba wiped out. As one of the leaders of AI in China, they may have some government tailwinds rather than headwinds if their business aligns with political strategy.

As far as we can tell now, the minority shareholder will benefit from the success of Alibaba, but this could change in the future.

Competition & No Switching Cost

Chinese consumers move on to different products much more quickly than western consumers. That means constant innovation is required to beat competition and keep customers. But this may depend on the business, for example I think cloud will be more sticky. US tech and Tencent are very good competitors.

Alibaba need to be mindful of their market share, given the low switching cost for most of their current business.

The innovation of these large Chinese tech companies has commoditised various digital platforms, like their shopping experience, chat and social media, hence the low switching cost. The high similarity between product offerings forces competitors to differentiate elsewhere, that will give them an advantage over others. We see this with JD’s excellent delivery, which Alibaba is now catching up on with Cainiao.

Revenue Recognition

In summary:

P4P marketing revenue is recognised when an ad is clicked.

In feed ads are prepaid and the related revenue is recognised when a user clicks their listing.

Display marketing services is prepaid and revenue is recognised either over the period of advertisement or when the ad is viewed by users.

Taobaoke commissions are recorded at transaction time.

Subscription fees are recognised over the subscription period.

Logistics services revenue is recognised at the time services are provided.

Cloud charged on either subscription or consumption basis. Subscription recognised over the period, consumption based on usage.

Sale of goods is recognised when control of goods are transferred to customers.

VIE Structure

Another potential risk is that China does not recognise Alibaba’s VIE contracts. This would be a huge deal, but highly unlikely. This would likely decouple them from the global economy as they would show that they don’t respect legal contracts / international laws.

Hard to put a probability on this, but I think we would see a lot of other warning signs before this risk occurs.

Intrinsic Valuation

In this section, I look at the fair value of Alibaba with a margin of safety including valuation multiples vs. industry and Alibaba’s history. Then, I show my range of DCF models to arrive at a fair value.

Have a look at my first post for a deep dive into Alibaba’s earnings and revenue sources. They largely rely on advertising from e-commerce, but are actively diversifying their income.

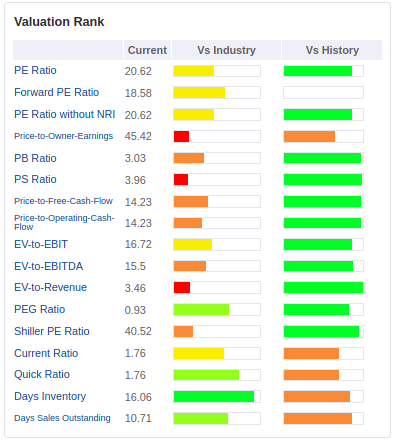

Multiples

Return on Invested Capital 5 Year Average (ROIC): 12%

Debt-to-Equity: 36%

Alibaba currently looks cheap on a historical basis, and as the leader in its industry pretty cheap too. Multiples are just a sanity check for me here.

Horizontal Analysis**

**This data is from March 2021.

Alibaba has a track record for growth that is pretty hard to beat. Even as a $500 billion dollar company, it is still growing revenue in high double digits. Revenue grew 34% YOY, not pictured here, from the most recent report.

Net profit margin has been sliding for the past few years, which is something to keep an eye on and may be indicative of increasing competition.

Vertical Analysis**

Healthy margins, but also slowly decreasing. Competition in China is fierce. Hard to predict a steady state, but as cloud gets up to scale they should help boost margins.

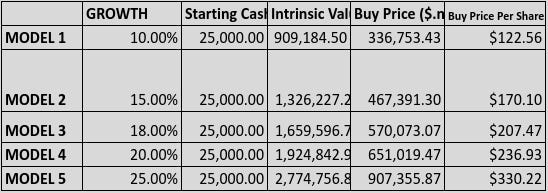

DCF

My estimates for Alibaba’s free cash flow is around $25B. I consider their current earnings, earnings power and a number of other factors to get to this number.

I cover conservative growth rates between 10% and 25%, which leads to a market capitalisation of $735B to $2.7T in 10 years. If I was to guess, I think the real outcome will be closer to $2.7T than $730B.

Using a 10 year DCF with a 15% discount rate, 2% risk free rate, and 6.7 P/FCF multiple (Y10 FCF / Discount Rate) as the terminal value, I get the following outcomes:

Changing the terminal value to a more reasonable but still conservative P/FCF multiple of 10 (Alibaba has been around 20+):

Our average value is somewhere around $195 per share, meaning a market cap of about $1.5T in 10 years.

Guru Interest

Charlie Munger and Monish Pabri are two notable investors who have purchased Alibaba in the last year. Both hold Alibaba as a significant chunk of their portfolio.

Tweedy Brown and many other respected value funds also hold positions. Reading through some of their published research is great for getting perspective of other successful investors.

Narrative & Numbers

Finally, bringing together my DCF estimates with a narrative of how the business could reach these growth and cash flow estimates in ten years.

Narrative 1:

Alibaba multiple comes down sharply, unprofitable businesses remain unprofitable. Cloud grows modestly, with equal market share with other big providers in China. E-commerce market share goes down, due to competition, consumer spending rises slower than expected.

Terminal market cap $750B-$1.3T.

May trade for only 5-15 P/FCF.

Average growth rate 10%-15%.

Lose market share to competitors in e-commerce.

Chinese middle class expands more slowly than expected.

Free Cash Flow Margin 15%-25%.

E-commerce margins are squeezed.

Cloud margins compensate for e-commerce and other bets.

Generated cashflows would come from e-commerce and cloud, with cloud as the majority.

Narrative 2:

Alibaba multiple comes down gradually, a few unprofitable businesses work well, Cloud grows modestly, with leading market share in China. E-commerce growth is in line with expectations.

Terminal market cap $1.3T-$1.7T.

May trade for 10-20 P/FCF.

Average growth rate 15%-20%.

Maintain market share in e-commerce and cloud.

Chinese middle class expands as expected.

Some bets are successful (Dingtalk, Amap or other).

Free Cash Flow Margin 20%-30%.

E-commerce margins reduce slowly.

Cloud margins compensate for e-commerce.

Other bets make small contribution to cashflows.

Generated cashflows would come from e-commerce, cloud and other bets. Majority cloud, then e-commerce, then small amount from other bets.

Narrative 3:

Alibaba’s multiple remains the same as historical. A number of unprofitable businesses work well. Cloud grows quickly, with leading market share in China. E-commerce growth is higher than expected.

Terminal market cap $1.7T-$3T.

May trade for 25-40 P/FCF.

Average growth rate 20%-30%.

Gain market share to competitors in e-commerce.

Chinese middle class expands more quickly than expected.

A number of other bets are successful.

Cloud expands more quickly than expected.

Free Cash Flow Margin 25%-40%.

E-commerce margins are maintained.

Cloud margins are big.

Other bets throws off a lot of cash.

Generated cashflows would come from and cloud, e-commerce and other bets in that order. Other bets may contribute similar amount of free cash flow as e-commerce.

Narrative 4:

$0, Donut.

Fraud or VIE contracts not honoured. In that case, just pack it in…

Summary

Undervalued, unloved alpha spawner.

There is a number of biases at play here. Home country bias most definitely, fear of the unknown and unfamiliar, poor recent momentum. The consensus has a very pessimistic outlook for Alibaba at the moment. But, if you read through the risks, you realise that most of these risks may not actually affect the underlying business all that much. Nonetheless, it is hard to hold a position the crowd has moved away from.

The catalysts and future drivers for growth for Alibaba as I see it are:

Improvement of US China relations.

Better cooperation of big Chinese tech with the government.

Expanding Chinese middle class, allowing Alibaba to capture more total dollars as well as wallet share.

China as a whole transitioning to more consumption, consumer spend trending higher from ~40% closer to 66% on parity with US.

Increasing transition to the cloud for Chinese companies, global growth of cloud computing.

Expansion of e-commerce to SE Asia and other parts of the world.

Other bets, potentially DingTalk or Ant Group successfully monetising their platforms.

That’s a Wrap 👋

If you read this far, subscribe!! Share this with someone who dismisses investing in Chinese companies so they can roast me :)

More stuff like this monthly.

Adios!